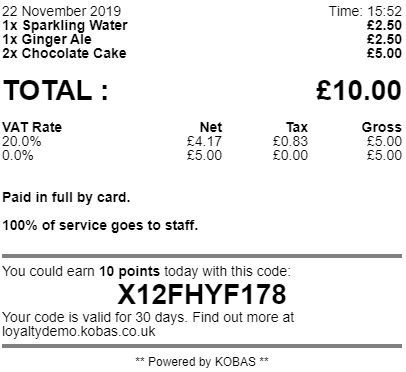

We’ve made some improvements to our VAT receipts. Now they’re clearer, neater and more informative!

The VAT summary on your receipts will, once this is released this week, be broken down by tax rate. Each tax rate will have columns that display the Tax Rate Percentage, and amounts allocated to Net Total, Tax Total and Gross Total.

For example, if you have an order that only has items at 20% tax (Standard Rate), you will see your receipt displayed like this:

And if you have an order that contains some items at 20% tax (Standard rate) and some items at 0% tax (Zero-rated), the bottom of your receipt will look like this:

With these changes, Kobas is completely prepared for any future VAT changes, and so are your venues! On top of that, Kobas EPoS will be ready to be deployed in other nations with different sales tax rates, which means we have some exciting times ahead.

That’s all for now. If you have any questions about these changes, please get in touch with our support team. Follow us on Twitter for more daily updates.