Everybody loves a discount. Whether you are getting money off your order or redeeming a pre-paid gift voucher you received for Christmas, discounts are a welcome bonus to any purchase.

Kobas already allowed you to create fixed value discounts, such as £5 off a bill, but we have now made the distinction between money off discounts and pre-paid vouchers clearer for both you and your customers.

- Discount (tax exempt) – This is when you are giving money off as a reward, apology when something has gone wrong or as a special offer. In this instance, tax is not charged on the discounted amount as the discount is essentially reducing the amount of money that is received for the item sold.

- Pre-paid (taxable) – This is used to allow redemption of pre-paid payment methods on your till, for example redeeming gift vouchers you have previously sold or when a customer has placed an advance deposit. In this instance, tax is not charged when the voucher is sold, but is applied to the full transaction value at the time of redemption. This is because the total amount of money received ultimately covers the full cost of the item purchased. More information about UK voucher VAT law.

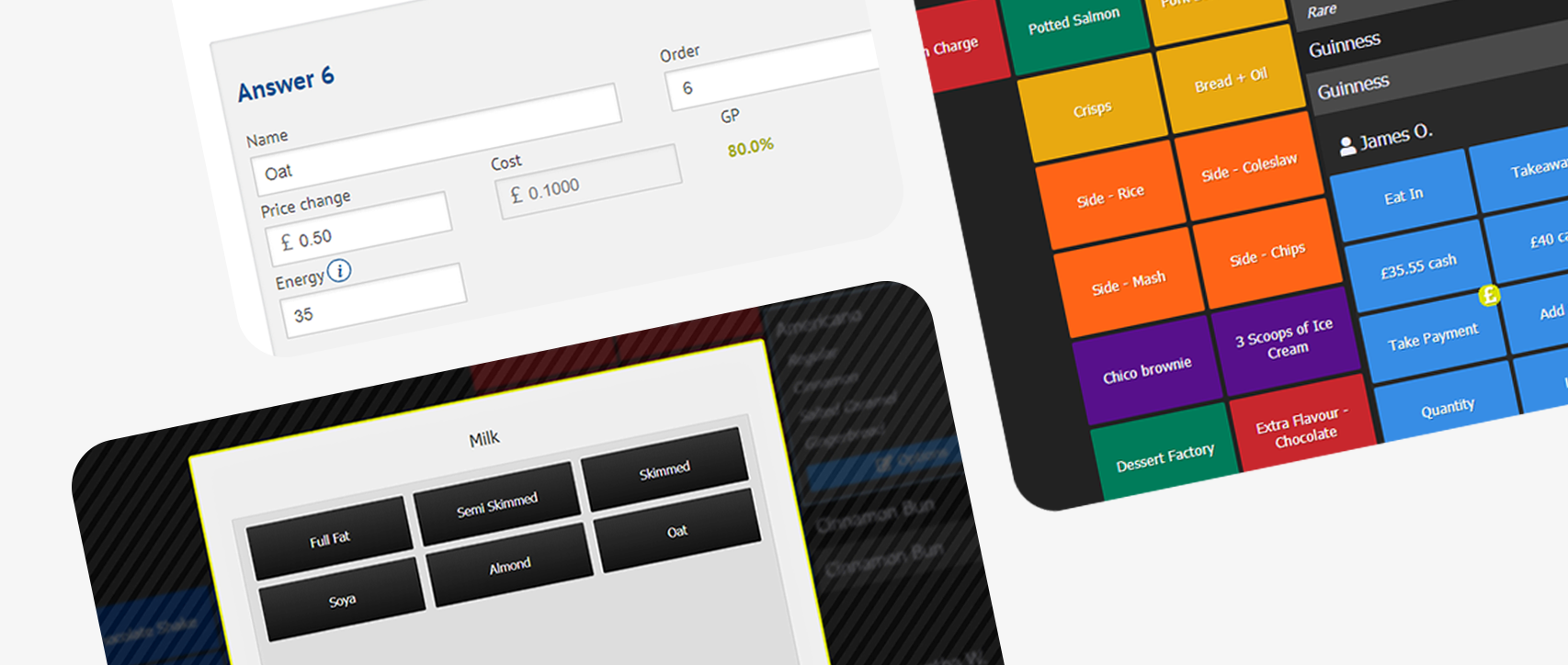

The distinction between the two is now displayed at every step of the process; when you set up the discount in Cloud’s Discount Manager; apply it to an order on the Take Payments screen on your EPoS; and in the payment method displayed on customers’ receipts.

For more information on other types of discounts and promotions, please see our guide.