There was great news for the industry when the government announced its new “Eat Out to Help Out” scheme for August 2020. This month will see participating venues offer diners a 50% discount on non-alcohol items, capped at £10 a head, Monday to Wednesday, subsidised by the Treasury.

Promoting bums on seats in the quieter parts of the week, we’re delighted to see assistance for our clients in these testing times.

From, a Kobas perspective, though, this presented quite the challenge! The terms of this discount don’t fall under any of our existing functionality, and with around 2 weeks warning, we had to work quickly to get something in place.

From the government guidance, we knew that:

- All non-alcoholic items are eligible for a 50% discount

- The discount only applies if the items are “Eat-In”

- Any discount must be capped at £10 per head

- VAT must apply on the full, non-discounted total

- Other eligible discounts must apply before the government discount kicks in.

With these stipulations, we knew that no existing functionality in Kobas would be able to deliver what our clients need and we needed to find a new solution.

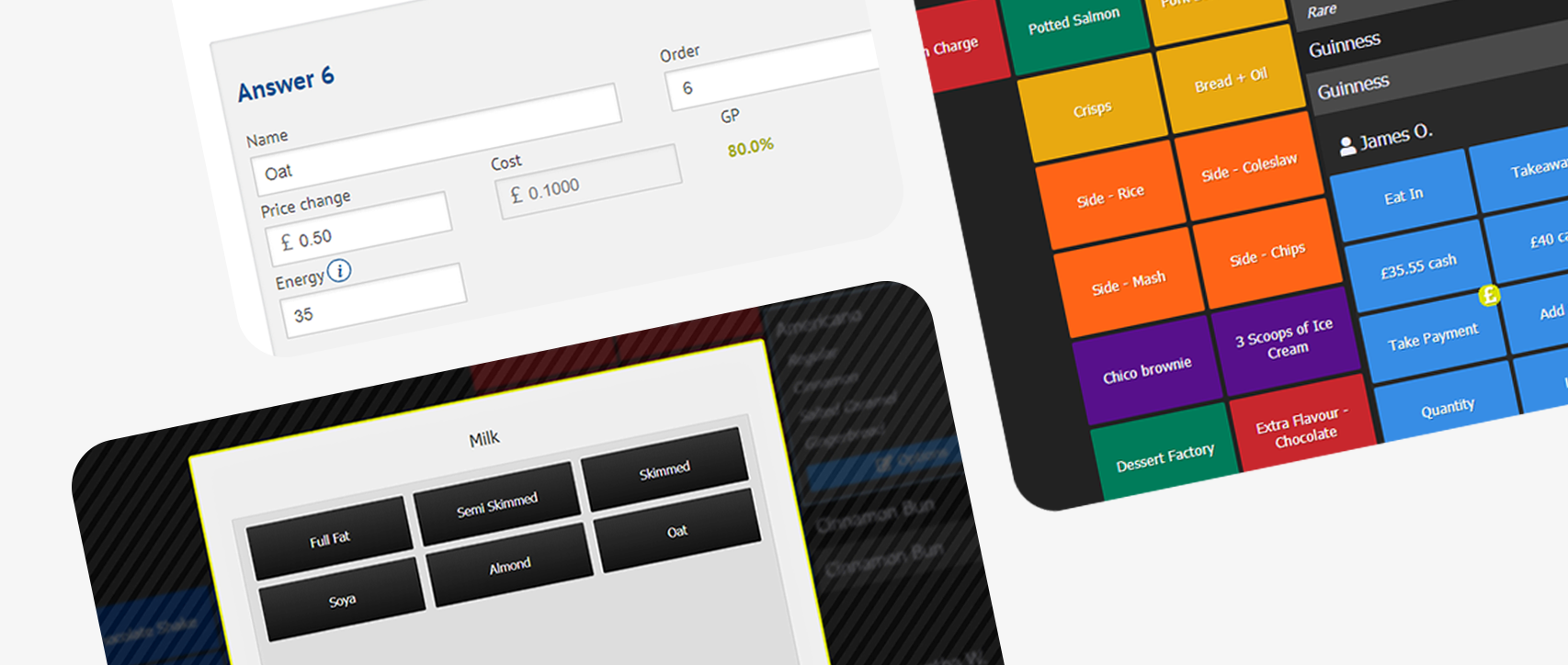

The solution on which we settled makes use of our existing “Other Payment Type” system. These are usually set up on a custom basis for our clients and are designed to allow the settlement of bills where neither cash or card, nor a discount has been used. A perfect example would be Deliveroo, or Just Eat.

To tackle this issue, we’ve released a new custom payment type named “Eat Out to Help Out”. Unlike existing types, this has special functionality attached to it, to allow for the government discount.

- The payment type is only available on Tabs, as unlike simple orders, a tab can have a number of covers associated with it. By using the covers, our new payment type can calculate the discount cap.

- The payment type will only look at “Eat-In” items.

These changes allow us to change the way a payment is taken. Usually, accessing the payment screen and selecting “Other” without inputting a figure will pay off the bill. When selecting “Eat Out to Help Out”, however, it will calculate 50% of all eligible items, and capping it at £10 per cover on the tab.

The main benefit of treating this as a payment type is that the following government requirements will happen automatically:

- VAT is calculated on the bill’s full total.

- Discounts can be applied to the bill, before any government discount is applied.

- Sales figures will be uploaded to Kobas Cloud, as normal.

- The Eat Out to Help Out payments will feature on the Cash Log.

To use the new discount, all you will need to do is access the “Part Pay” or “Settle” screens from the Tab view. If the payment is enabled in your account, then this will appear as an option. Selecting it will automatically apply the correct discount.

If, for any reason, your tab changes after the discount has been applied, the discount will update appropriately. So, changes in items, or changes to discounts, will automatically update the total amounts.

This functionality is live on EPoS now, but to enable it for your company, please get in touch with our support team.